India–UK Deepen Collaboration in AI & HealthTech Innovation:..

India–UK Deepen Collaboration in AI & HealthTech Innovation: Building a Smarter Future IntroductionIndia...

Loading

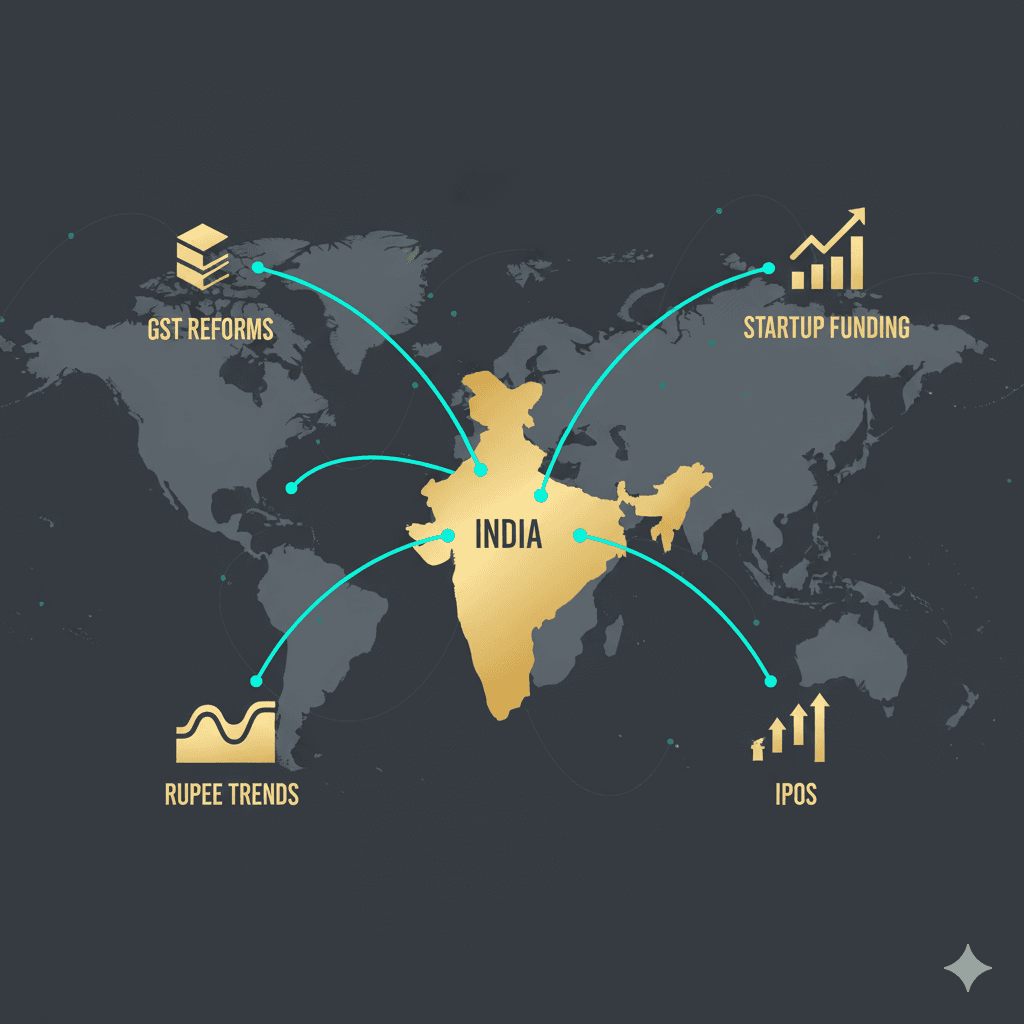

Taxation compliance which needs to be checked regularly can be divided into Direct and Indirect TaxIn Direct Tax – Tax Deduction on Source (TDS) is the focus area to look on.There are various sections and rates for TDS as notified by government ranging between 1% to 30%TAN or Tax Deduction and Collection Number (TAN) is mandatory 10 digit alpha number required to be obtained by all persons who are responsible for Tax Deduction at Source (TDS) or Tax Collection at Source (TCS) on behalf of the Government whether individual/firm/company or any other setup. Tax deducted at source (TDS) ensures that the Government’s collection of tax is preponed helping government to monthly revenue and the responsibility for paying tax is diversified. The person deducting the tax at source is required to deposit the tax deducted to the credit of Central Government – quoting the TAN number at certain date which is 7th of next month except March , in case not able to do so than interest is charged.Those entities have TAN Registration must then file TDS returns. TDS and TCS returns are due quarterly and need to be filed on time otherwise late filing charges are applicable

31Oct

31OctIndia–UK Deepen Collaboration in AI & HealthTech Innovation: Building a Smarter Future IntroductionIndia...

30Oct

30OctGlobal Growth Outlook 2026: Tariff Hangover Meets Relief from Falling Oil Prices...

29Oct

29OctIndia’s Global Business Moves: Cross-Border Acquisitions & Strategic Investments (October 2025) India’s...