India–UK Deepen Collaboration in AI & HealthTech Innovation:..

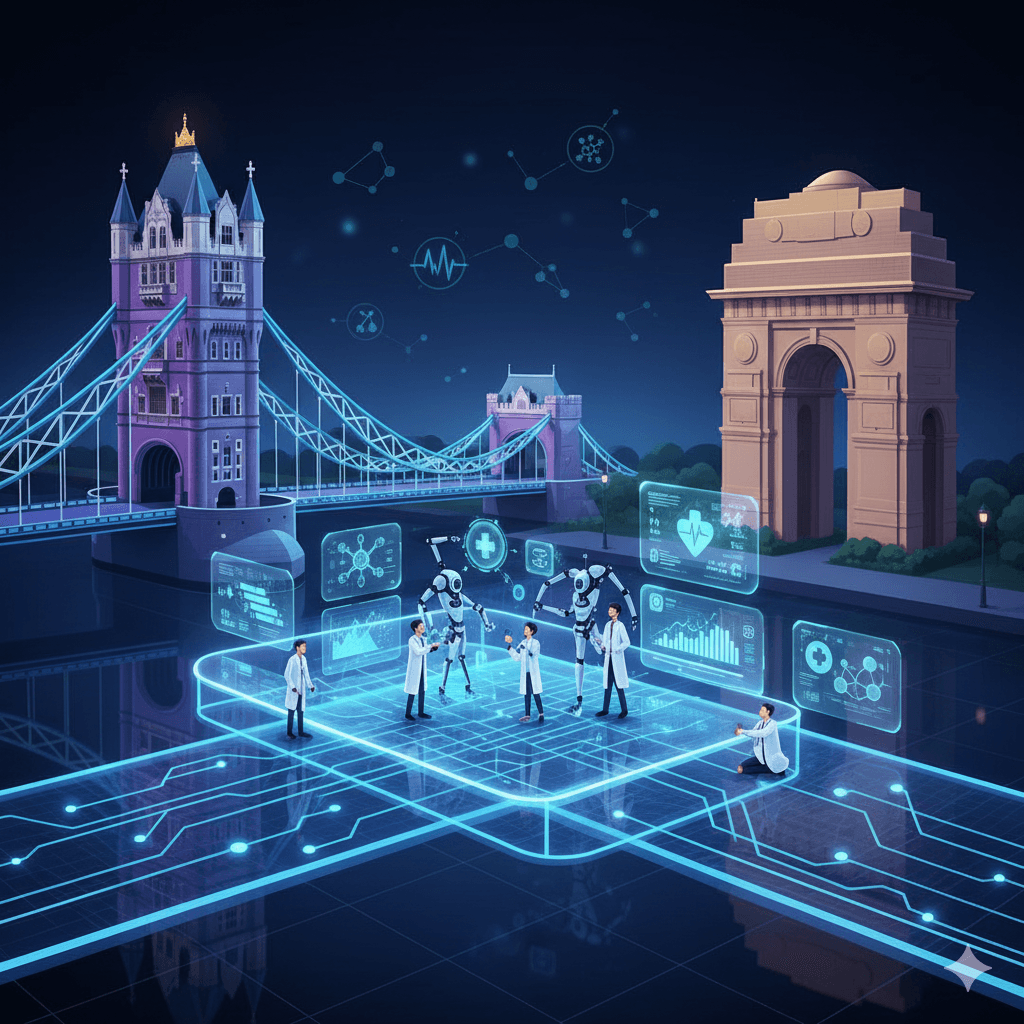

India–UK Deepen Collaboration in AI & HealthTech Innovation: Building a Smarter Future IntroductionIndia...

Loading

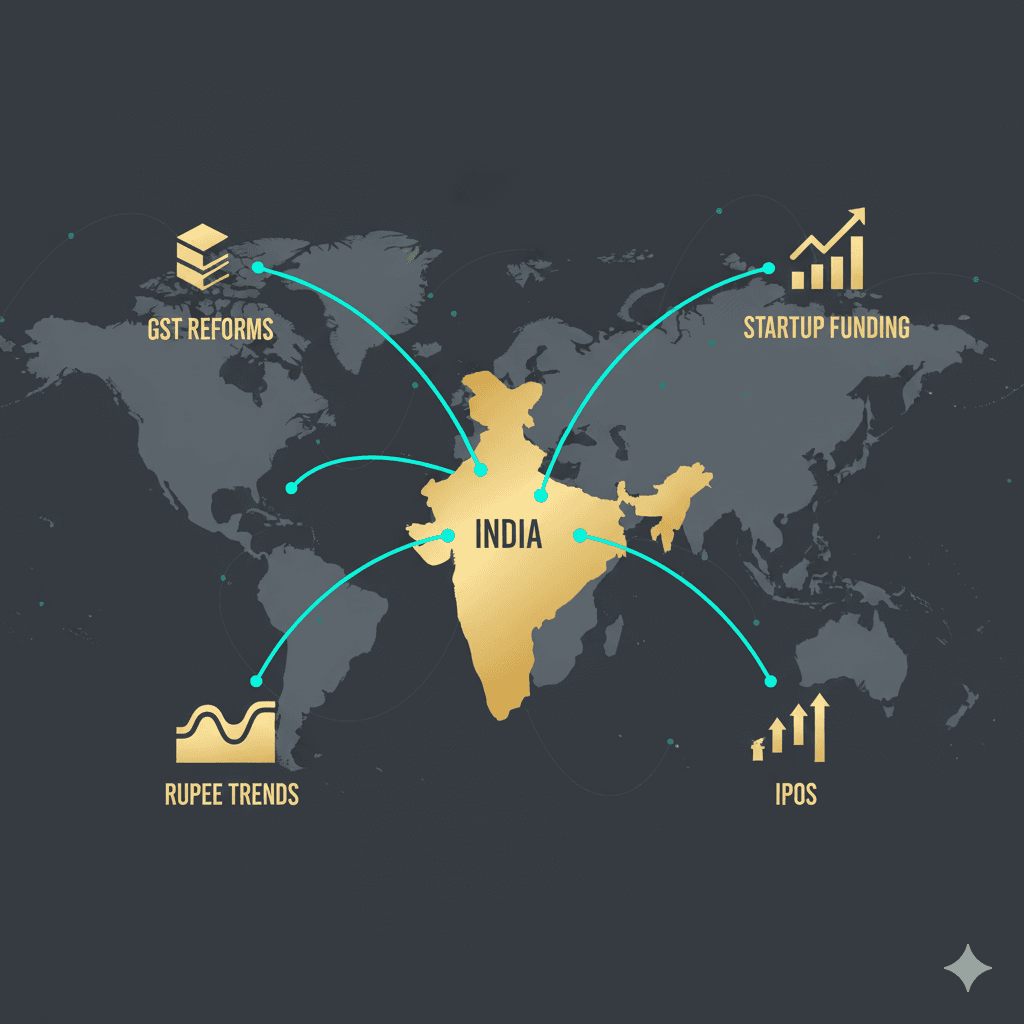

Professional tax is levied by particular Municipal Corporations and majority of the Indian states impose this duty. It is a source of revenue for the government. The maximum amount payable per year is INR 2,500 and in line with tax payer’s salary, there are predetermined slabs. It is also payable by members of staff employed in private companies. It is deduced by the employer every month and sent to the Municipal Corporation. It is a mandatory to pay professional tax. The tax payer is eligible for income tax deduction for this payment.

31Oct

31OctIndia–UK Deepen Collaboration in AI & HealthTech Innovation: Building a Smarter Future IntroductionIndia...

30Oct

30OctGlobal Growth Outlook 2026: Tariff Hangover Meets Relief from Falling Oil Prices...

29Oct

29OctIndia’s Global Business Moves: Cross-Border Acquisitions & Strategic Investments (October 2025) India’s...