India–UK Deepen Collaboration in AI & HealthTech Innovation:..

India–UK Deepen Collaboration in AI & HealthTech Innovation: Building a Smarter Future IntroductionIndia...

Loading

What is the meaning of a Private Limited Company?

A Private Limited Company (Pvt Ltd) is a business entity where ownership is confined to a limited number of shareholders, and its shares are not available for public trading on stock exchanges. This structure ensures that control remains within a close-knit group of individuals or entities.

Private limited company meaning as per Section 2 (68) of the Companies Act, 2013 is A Company having a minimum paid-up share capital as may be prescribed and which, by its articles

With the startup ecosystem booming across the country and more and more people looking to do something on their own, there is a need to be well-acquainted with different business registration types, i.e. sole proprietorship, limited liability company, and private limited company.

Private Limited Company Examples

Here are some examples of private limited companies in India

Types of Private Limited Company

There are three types of Private Limited Company registrations, and entrepreneurs can choose the one that best suits the needs of their business.

Characteristics of a Private Limited Company

Following are some of the main advantages of a private limited company:

The act mandates that a minimum of two shareholders are required to start such a company, while the limit for maximum number of members is fixed at 200.

The Act specifies the number of directors in a private limited company, requiring a minimum of two directors, while allowing a maximum of up to 15 directors.

In a private limited company, the liability of each member or shareholder is limited. Therefore, even in the case of loss under any circumstances, the shareholders are liable to sell their assets for repayment. However, the personal and individual assets of the shareholders are not at risk.

This is a separate legal entity and continues in perpetual succession. This means that even if all the members die, or the company becomes insolvent or bankrupt, the company still exists in the eyes of the law. The life of the company will be perpetual, not affected by the lives of its shareholders or members unless dissolved by way of resolution.

A private limited company is required to have and maintain a minimum paid-up capital of ₹1 lakh. It could go higher, as prescribed by MCA from time to time.

Requirements to Start a Private Limited Company

Every business type has its own set of requirements before it is incorporated.

The requirements for registering this are as stated below:

As mentioned above, to get itself legally registered, a private limited company means it must show a minimum number of two and a maximum number of 200 members. This is a statutory requirement as mandated by the Companies Act 2013.

The directors should meet the following conditions:

Choosing the name of the company is often a technical task. A private limited company is required to cover three aspects while deciding a name for itself:

Pro tip: It is not always necessary that the name the business owner is looking for will be available, as no two companies can have the same name. Therefore, it is a requirement that at the time of registration, every company has to send 5-6 names for approval to the Registrar of Company (ROC). Moreover, the submitted names should not have a close resemblance with any other company’s name.

After the company has been registered, the permanent address of its registered office must be filed with the registrar of the company. The registered office of the company is where the company’s main affairs are being conducted and where all the documents are placed.

For electronic submission of documents, every company must obtain a digital signature certificate that is used to verify the authenticity of the documents. Moreover, in a company employing professionals (secretaries, chartered accountants, cost accountants, etc.) for varied activities, certifications by these professionals are necessary.

List of Documents Required for Private Limited Company

The documents required to incorporate a Pvt Ltd company include:

Document verifying the identity of individuals such as PAN card and passport of Indian and foreign directors, respectively.

Document confirming the residential address of individuals such as utility bills or rental agreements.

Unique identification number allotted to directors by the Ministry of Corporate Affairs.

Electronic signature ensuring the authenticity of documents filed electronically.

Legal document defining the company’s objectives and scope of operations.

Document outlining the rules and regulations governing the internal management of the company.

Formal statement by directors and subscribers confirming compliance with legal requirements for company incorporation.

Consent from the landlord permitting the use of premises as the company’s registered office.

Overview of the distribution of shares among shareholders in the company.

Documentation confirming the address where the company is registered and operates from.

How to Register Pvt Ltd Company? A Step-by-Step Guide

To register a private limited company in India the following steps are mandatory:

STEP 1: Choose a Unique Name for Your Business

STEP 2: Obtain Digital Signatures from Authorised Agency

STEP 3: Obtain Director Identification Number (DIN) from MCA Portal

STEP 4: Prepare Memorandum and Articles of Association

STEP 5: Get Consent and Declarations

STEP 6: Apply for Company Name Approval

STEP 7: File Incorporation Documents

STEP 8: Pay Registration Fees

STEP 9: Verification and Approval

STEP 10: Obtain PAN and TAN

STEP 11: Open a Bank Account in a Company’s Name

STEP 12: Obtain Business Licenses

Licencing and permit requirements can differ depending on the nature of your business.

You may need to obtain them from various authorities, such as:

STEP 13: Register Your Business Under GST

STEP 14: Commence Business Operations

It assists organisations in efficiently controlling the company's income and expenditure while monitoring managerial policies and goals.

Helps in measuring the performance of the business in terms of key measures such as net profit, sales growth, and so on.

Keeping track of the money that comes into the business on a regular basis helps in projecting patterns, paying employees and suppliers, repaying debts, etc.

Investors will gain a better understanding of the business's financial health, including its solvency, creditworthiness, liquidity, stock, and bond issuers.

Proper compliances, planning and transparency builds stakeholder and public confidence in the company.

31Oct

31OctIndia–UK Deepen Collaboration in AI & HealthTech Innovation: Building a Smarter Future IntroductionIndia...

30Oct

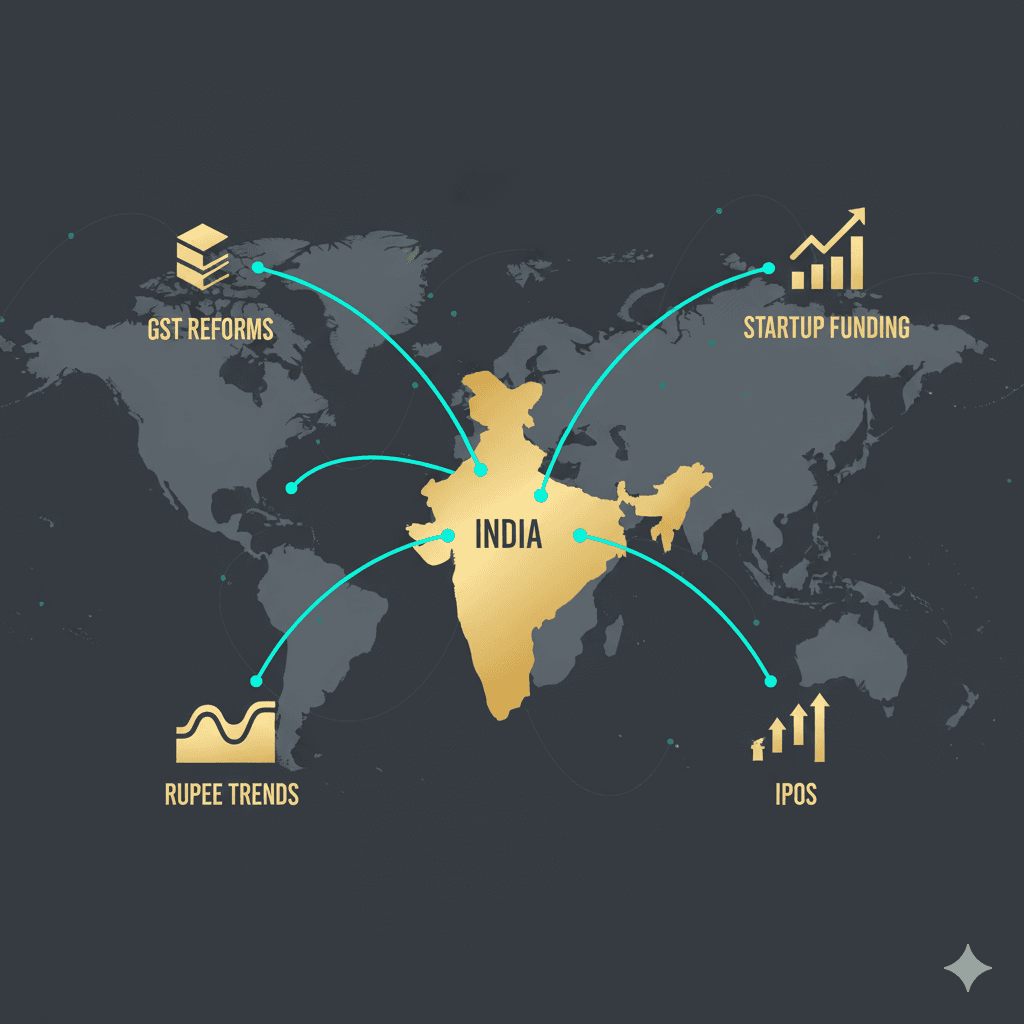

30OctGlobal Growth Outlook 2026: Tariff Hangover Meets Relief from Falling Oil Prices...

29Oct

29OctIndia’s Global Business Moves: Cross-Border Acquisitions & Strategic Investments (October 2025) India’s...