India–UK Deepen Collaboration in AI & HealthTech Innovation:..

India–UK Deepen Collaboration in AI & HealthTech Innovation: Building a Smarter Future IntroductionIndia...

Loading

Partnership firms in India can be divided into two categories namely, registered partnership or unregistered partnership. Registered partnership firms are those firms having a registration certificate from the Registrar of Firms. All other partnerships that do not have a registration certificate would be classified as an unregistered partnership firm. Under Income Tax Act, a partnership firm is defined as “Persons who have entered into a partnership with one another are called individually “partners” and collectively “a firm”, and the name under which their business is carried on is called the “firm name”. In this article, we look at the procedure for filing tax return for partnership firm along with tax rate and the deadline for tax filing.

Income tax return of a partnership firm can be filed online through the income tax website or manually. If the income tax return is filed online, then a class 2 digital signature will be required for the Partner of the firm. Also, online income tax return filing is mandatory for partnership firms required to obtain an audit.In case of manual filing, the assessee must print out two copies of Form ITR-V. One copy of ITR-V signed by the assessee, has to be sent by ordinary post to Post Bag No. 1, Electronic City Office, Bengaluru–560100 (Karnataka). The other copy should be retained by the assessee for his/her record.

What is Sole Proprietorship?

According to the name, sole denotes “only one”, and proprietorship denotes ownership. A sole proprietorship is a business entity where a single person oversees all the company’s operations. The term “sole proprietor” can also refer to a sole trader. The sole proprietor of this business unit is in charge of raising the initial capital for the company. The individual is also in charge of controlling every aspect of management.

A sole proprietorship must file annual returns for a variety of reasons. It ensures that all legal and regulatory requirements are met, assisting the company in avoiding fines and legal repercussions. Accurate financial records kept through annual filings allow for proper taxation and make corporate operations more transparent. Additionally, the proprietorship can take advantage of incentives and privileges offered to enterprises that comply with the law. It offers essential information about the company’s financial performance and health to stakeholders, including lenders and investors. Annual filing is essential for upholding good governance and fostering confidence in the commercial ecosystem.

Key Take Aways:

Annual Filing Requirements for a Registered Sole Proprietorship in India

Business Registration

There are certain procedures and requirements to form a sole proprietorship in India. The first stage is getting the essential licenses and permits for the company’s operation. Licenses issued by regional organizations, like municipal corporations or health departments, may fall under this category. Additionally, registering with such a business is crucial if the company is subject to any particular regulatory agencies.

PAN Card

The Income Tax Department’s Permanent Account Number (PAN) is required to register a Sole Proprietorship in India which is not separate but the PAN Number of Individual/Proprietor himself. PANs are unique 10-digit alphanumeric IDs issued by the Income Tax Department to individuals and companies. The PAN (Permanent Account Number) is crucial for several reasons. First, PAN acts as a distinctive identifier for the company, facilitating easy financial transactions. Opening a bank account to conduct financial activities, accept payments, and make payments is important. Second, PAN is a requirement for filing income tax returns. Ensuring proper tax assessment and compliance with tax legislation enables the sole proprietor to submit both their business and personal income under a single PAN. In addition to battling tax evasion and proving the legality, trustworthiness, and compliance of a single proprietorship, PAN aids in maintaining transparency and accountability in the tax system.

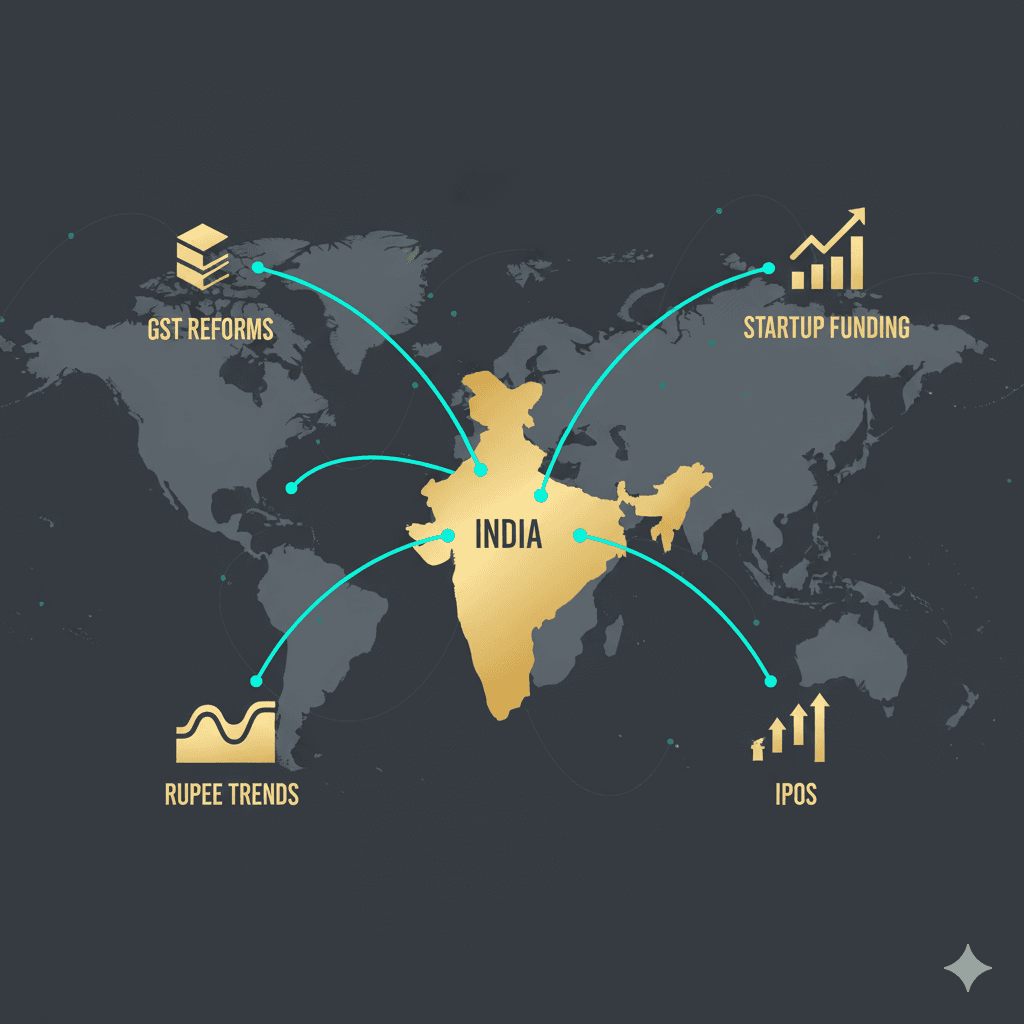

GST Registration

Businesses in India that generate more revenue than the set threshold must register for GST (Goods and Services Tax). It entails getting the sole proprietorship a special GST identification number. A sole proprietor registered for GST can file GST returns, collect and remit GST on taxable supplies, and claim input tax credits. Additionally, it makes it simpler for sole proprietorships to benefit from all of the safeguards and advantages provided by the GST regime and ensures that business transactions are transparent.

Income Tax Return Filing

In India, submitting an income tax return (ITR) is an essential annual requirement for a sole proprietorship. It involves notifying the tax authorities of the business’s earnings, outlays, and other financial information. Compliance with tax rules, accurate tax assessment, and avoidance of fines or other repercussions for the sole proprietorship are all ensured by proper ITR Filing.

In India, when it comes to taxes, proprietorships have the same responsibilities as their owners. A proprietorship is an extension of the owner, meaning the tax process is quite similar to what individuals go through. The income tax rules that apply to individual proprietors also apply to proprietorships.

Mera Compliance Team would understand business

Day 1-Client To Share Documents With Mera Compliance Team

Day 1- Apply for GST, MSME, Trademark and Shop Act License

Day 2- MSME License,Trademark and Shop Act License Done

Day 7-GST Registration Done For The Business

Congratulations, now you can start your business

31Oct

31OctIndia–UK Deepen Collaboration in AI & HealthTech Innovation: Building a Smarter Future IntroductionIndia...

30Oct

30OctGlobal Growth Outlook 2026: Tariff Hangover Meets Relief from Falling Oil Prices...

29Oct

29OctIndia’s Global Business Moves: Cross-Border Acquisitions & Strategic Investments (October 2025) India’s...