Digital Payments and Financial Inclusion: India’s Fintech Revolution in 2025

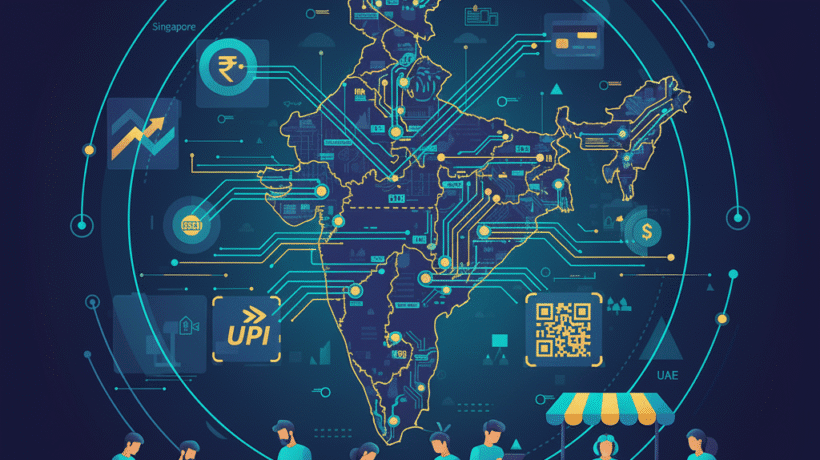

India’s journey toward a cashless, inclusive financial ecosystem continues to set global benchmarks. With digital payments accounting for nearly all transactions in the first half of 2025, the country’s financial landscape has become a showcase for technology-driven growth, accessibility, and transparency. This transformation—powered by UPI, RTGS, and card-based ecosystems—has redefined how individuals and businesses transact, save, and invest.

Understanding India’s Digital Payment Growth

India’s digital payment ecosystem has grown exponentially over the past decade, reflecting both policy reforms and consumer adoption. In H1 2025, digital transactions represented 99.8% of total transaction volume and 97.7% of total value—a historic high that underscores the nation’s digital maturity.

Over the ten years ending 2024, digital transactions expanded:

38x in volume

3x in total value

This growth has been driven by the Unified Payments Interface (UPI), which now accounts for 85% of transaction volume, followed by RTGS, which dominates 69% of transaction value despite comprising only 0.1% of total transaction count.

Key Metrics: India’s Digital Payment Landscape (H1 2025)

Total Transactions: 12,549 crore

Total Value: ₹1,572 lakh crore

UPI QR Codes Deployed: 6.8 crore

Debit Cards in Circulation: 100 crore+

Credit Cards: 11.1 crore

POS Terminals: 1.18 crore

These figures illustrate India’s position as a world leader in real-time payments, surpassing major economies in both reach and adoption rate.

Policy Push: RBI, NPCI, and Government Initiatives

The Reserve Bank of India (RBI), National Payments Corporation of India (NPCI), and the Ministry of Finance have all played pivotal roles in this transformation:

RBI’s Digital Payments Vision 2025 emphasizes inclusion, interoperability, and fraud reduction.

NPCI’s global UPI partnerships with countries like Singapore and the UAE have expanded cross-border payment accessibility.

Government-backed digital literacy programs under Digital India and Jan Dhan Yojana continue to bring millions into the formal banking ecosystem.

Together, these efforts ensure that even MSMEs, rural entrepreneurs, and small traders can seamlessly participate in India’s fast-evolving financial economy.

Global Context: India as a Fintech Superpower

Globally, India leads the real-time payments revolution, processing more transactions annually than the US, UK, and China combined.

While nations like Singapore and Brazil have adopted faster payment systems, India’s UPI model remains unmatched in scale and inclusivity.

Cross-border pilots and UPI-linked international remittances are now bridging financial gaps for NRIs and global merchants alike.

This ecosystem positions India as a blueprint for financial inclusion in emerging economies.

Benefits & Challenges Ahead

Benefits

Instant payments: Seamless 24×7 transfers.

Financial inclusion: Access for rural and low-income users.

Transparency: Digital audit trails reduce tax evasion.

Lower costs: Minimal transaction fees for merchants and MSMEs.

Challenges

Cybersecurity risks amid rising transaction volumes.

Digital divide in rural connectivity.

Need for global standardization in UPI remittance frameworks.

To sustain momentum, India must balance innovation with robust regulation, ensuring both safety and accessibility for all users.

Key Takeaways

India processed ₹1,572 lakh crore worth of digital payments in H1 2025.

UPI dominates in volume; RTGS leads in value.

100 crore+ debit cards and 6.8 crore UPI QR codes signify deep market penetration.

India’s model is being replicated globally for financial inclusion success.

Conclusion

India’s digital payment revolution is not just about convenience—it’s a symbol of inclusive economic empowerment. By integrating technology, policy, and innovation, India has built a financial system that serves everyone—from global corporations to street vendors. As the country moves toward UPI 3.0 and AI-driven financial compliance, the next phase will focus on security, accessibility, and global interoperability.

Stay ahead of the curve — visit meracompliance.com

to keep your business compliant, digital, and future-ready.

FAQ'S

1. What percentage of India’s transactions are digital in 2025?

Digital payments accounted for 99.8% of transaction volume and 97.7% of value in H1 2025.

2. Which payment method dominates India’s digital ecosystem?

UPI leads with 85% of all transaction volume.

3. How does RTGS contribute to India’s payment landscape?

While RTGS represents only 0.1% of transaction count, it covers 69% of total value, used mainly for high-value payments.

4. What role does RBI play in digital payment regulation?

RBI oversees security, interoperability, and innovation under its Digital Payments Vision 2025 roadmap.

5. How does digital payment growth support financial inclusion?

It brings millions into the formal economy, improving credit access, transparency, and small business participation.