India–UK Deepen Collaboration in AI & HealthTech Innovation:..

India–UK Deepen Collaboration in AI & HealthTech Innovation: Building a Smarter Future IntroductionIndia...

Loading

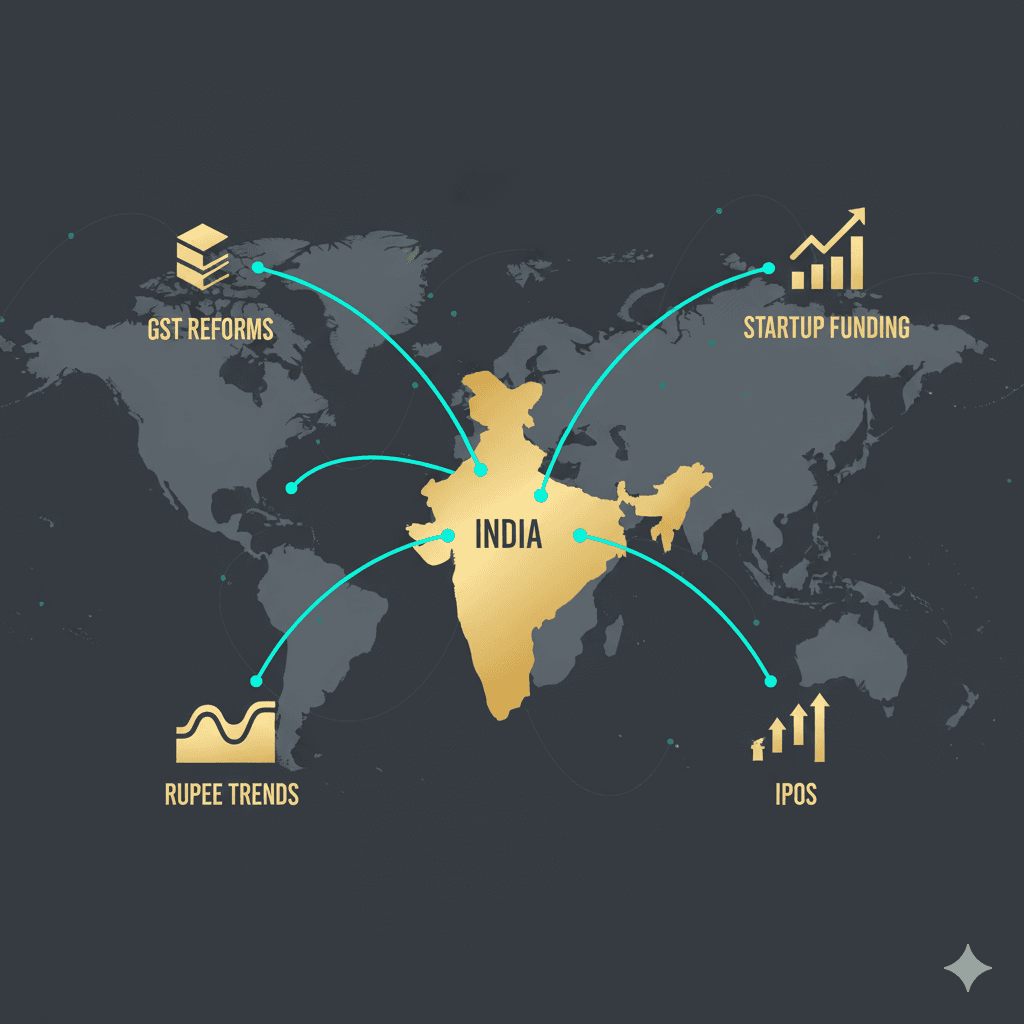

After Indian government has launched “Make In India” campaign and incentives provided and red tapism has been removed; foreign companies are looking for Indian market as it is growing at a rapid speed, also resources are readily available in INDIA. A Foreign National (other than a citizen of Pakistan or Bangladesh) or an entity incorporated outside India (other than entity incorporated in Pakistan or Bangladesh) can invest and own a Company in India by acquiring shares of the Indian company which is subject to the FDI Policy of India. Also other main criteria is a minimum of one Indian Director who is a Indian Director and Indian Resident is required for incorporation of an Indian Company along with an address in India.Foreign Companies can invest in India through 2 ways- automatic route and investment under Government approval route.“Automatic Route- In terms of Regulation 6 of the Notification No. FEMA 120/RB-2004 dated July 7, 2004, as amended from time to time, an Indian Party has been permitted to make investment / undertake financial commitment in overseas Joint Ventures (JV) / Wholly Owned Subsidiaries (WOS), as per the ceiling prescribed by the Reserve Bank from time to time.With effect from July 03, 2014, it has been decided that any financial commitment (FC) exceeding USD 1 (one) billion (or its equivalent) in a financial year would require prior approval of the Reserve Bank even when the total FC of the Indian Party is within the eligible limit under the automatic route (i.e., within 400% of the net worth as per the last audited balance sheet). There is a detailed list of business and investment along with rules and regulations which need to kept in mind while investing through Automatic Route, Foreign Direct Investment of up to 100% is allowed under the automatic route in most activities/sectors in India.”Investment in activities / industries where automatic route is not available can be made with the approval of the Government under the Government Approved FDI method.

31Oct

31OctIndia–UK Deepen Collaboration in AI & HealthTech Innovation: Building a Smarter Future IntroductionIndia...

30Oct

30OctGlobal Growth Outlook 2026: Tariff Hangover Meets Relief from Falling Oil Prices...

29Oct

29OctIndia’s Global Business Moves: Cross-Border Acquisitions & Strategic Investments (October 2025) India’s...