India–UK Deepen Collaboration in AI & HealthTech Innovation:..

India–UK Deepen Collaboration in AI & HealthTech Innovation: Building a Smarter Future IntroductionIndia...

Loading

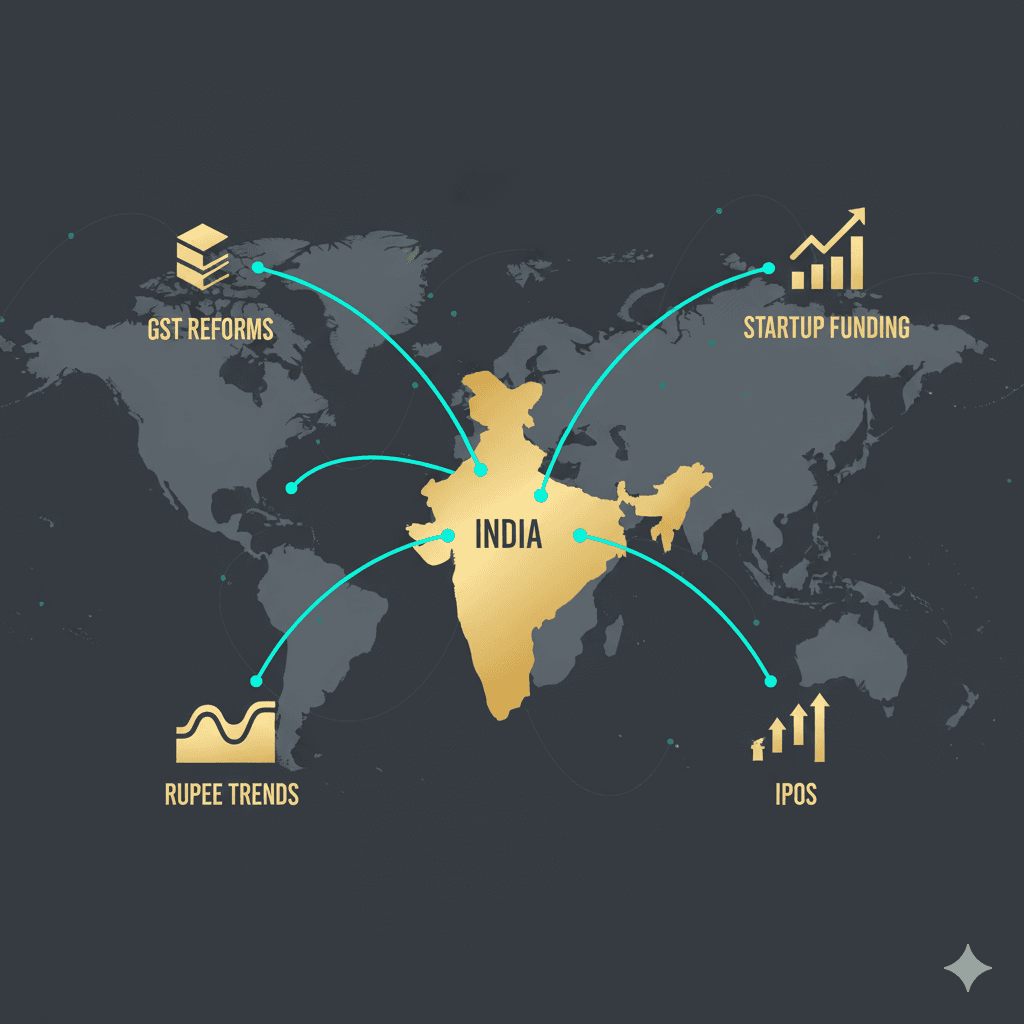

What is GST registration online? GST registration online was very famous after the Goods and Services Tax (GST) big Tax reform in India, which combines earlier applicable indirect taxes & several levies into a single tax structure, which includes central excise duty, services tax, additional custom duty, surcharges, central sales tax and state level value added tax, luxury tax, electricity duty, entertainment tax, entry tax and octroi. Under the GST regime, goods and services are now taxed under a single legislation, the Goods and Services Tax Laws. All of the taxes are imposed at the same time. The CGST, SGST, and IGST are divide the income between the federal and state governments.GST registration online is voluntary or mandatory process in India. It depends on turnover of the businesses or services, that the every person is mandatorily apply for GST registration online, who has cross the turnover limit during the previous financial year or expected to cross the limit as prescribed under GST law. Meaning of limit is here from threshold limit.GSTIN Registration is nessesary for save huge tax penalties or fines, Kcorptax is one of the best GST registration online service providers in Delhi NCR, with the help of our expertization of more than 15 years, you may get registered your business under GST, whether you are from Delhi NCR, Mumbai, Chennai or Kolkatta or from any other place in India.

If you are looking for GST registration online or GST registration process, you can first visit to official website of GST GSTn Services and fill the registration form online and followed the steps as mentioned below. You can also read No. of documents required for GST registration in Delhi and step by step procedure for GST registration online in Delhi. Also note that, GST online application and procedure for GST registration online in India is same for every State or Union Territory, whether you apply for registration in any State/ Union Territory of India. You can also consult with our GST registration expert team, Kcorptax is one of best GST registration consultant in Delhi NCR.

Businesses that satisfy specific conditions, such as turnover or activity, must register for GST. If the yearly turnover of selling goods or providing services reached Rs. 40 lakhs or Rs. 20 lakhs respectively. Businesses those have manufacturing goods and delivering services in the northern eastern states, the amounts are Rs. 20 lakhs and Rs. 10 lakhs respectively. Many traders opt to register for GST on their own voluntarily because of the so many benefits. In India, registration process is only online. GST registration online is ensured a smooth flow of input tax credit & also create your status as a registered supplier. For more discussion or if you want to get GST registration in Delhi NCR, you may contact us at our offices at Preet Vihar Delhi or Registration Expert (A unit of Kailadevi Corporate) at Greater Noida near Gaur City Mall and get free expert advice or guidance for GST registration online in Delhi and nearby areas.

CGST (Central Goods and Services Tax): The tax collected by it will go to the center. SGST(State Goods and Services Tax): The tax collected by it will go to the state. IGST (Integrated goods and Services Tax): It will only apply when sending products or services from one state to another. UTGST (Union Territory Goods and Services Tax): This tax is applicable in the 7 Union Territories of the country.

Input tax credit will reduced the price Once you get GST registration online, you will allow to collect GST and passed ITC to another registered GSTIN holders, further they can claim credit of the GST paid to you or prior suppliers for business operations. Hence it will reduce the cost of inputs that reduced ultimately the cost of supplies.

A supplier can legally collect GST, once he or she get GST registration online either voluntary or mandatory. Further the GST input credit might be passed by them. The voluntary registrant has the same status and duties as a taxpayer who has met the statutory requirements. The registrants will issue a Tax Invoice (i.e. called pakka invoice) also to the customers by using this registration.

Kcorptax have experienced law specialists (like CA, CS, Lawyers etc) who provides expert guidance & support for GST Registration online in Delhi to make it simple and hassle free, the online registration procedure is made easier. After the registration procedure is completed, certificate of GST registration online will be given to the applicant that includes the GST number, also known as the GSTIN. The GST registration issued permanently till date of surrender or cancelled it and does not require renewal at any time but it may be amended as if required any change in any basic information, address or other particulars submitted earlier.

Once you get GST number, each registrant is responsible for ensuring GST compliance in the form of timely payment of GST & submission of online GST returns like GSTr-1 and GSTr-3B. Under the GST regime, these compliance obligations are simplified. It is also systematically planned to make compliance easier by consolidating several submissions in a single return. When trying to compare it to many other taxpayers, a regular taxpayer will receive a better GST compliance rate.

31Oct

31OctIndia–UK Deepen Collaboration in AI & HealthTech Innovation: Building a Smarter Future IntroductionIndia...

30Oct

30OctGlobal Growth Outlook 2026: Tariff Hangover Meets Relief from Falling Oil Prices...

29Oct

29OctIndia’s Global Business Moves: Cross-Border Acquisitions & Strategic Investments (October 2025) India’s...