India–UK Deepen Collaboration in AI & HealthTech Innovation:..

India–UK Deepen Collaboration in AI & HealthTech Innovation: Building a Smarter Future IntroductionIndia...

Loading

A Digital Signature Certificate (DSC) is necessary to submit various online forms to the Government of India. It is used to sign electronic documents, emails, and other digitally transmitted documents. They enhance enhance security using encryption technology. DSCs are predominantly utilised when businesses need to digitally sign online documents, securely authenticate the signature, and validate the signed copy.

What is a Digital Signature Certificate (DSC)?

A Digital Signature Certificate (DSC) is a secure digital key that is issued by the Certifying Authorities (CA) for the purpose of validating and certifying the identity of the person holding this certificate. Digital Signatures make use of the public key encryptions to create the signatures.

A DSC contains information about the user’s name, pin code, country, email address, date of issuance of certificate and name of the certifying authority. The DSCs are usually valid for one to two years. However, they can be renewed before the expiry period.

Digital Signature Certificate Advantages

Importance of DSC for Fulfilling Statutory Compliances

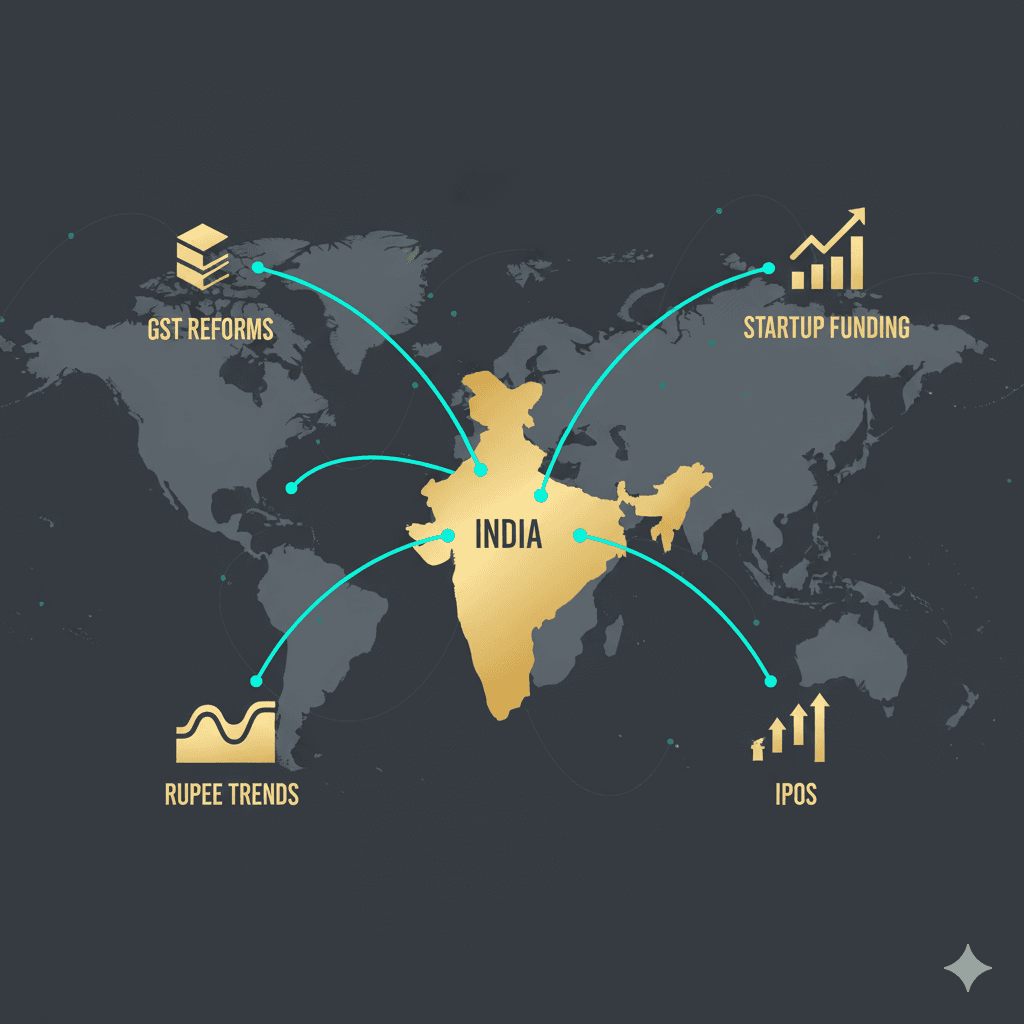

Individuals and entities who are required to get their accounts audited have to file their income tax return compulsorily using a digital signature. Furthermore, the Ministry of Corporate Affairs has made it mandatory for companies to file all reports, applications, and forms using a digital signature only.

Under GST also, a company can get registered only by verifying the GST application through a digital signature. The use of a digital signature is necessary even for filing all applications, amendments and other related forms.

Certifying Authorities for Issuance of a Digital Signature Certificate

The Controller of Certifying Authorities (CCA) has appointed Certifying Authorities (CA) for issuing DSC in India. The Office of the Controller of Certification Agencies (CCA) has given authority to 15 CAs to issue DSCs to persons. The list of the CAs, along with their website link, is given here.

Sign

A person can use Sign Certificates for signing a document. It can be affixed to a PDF, files or documents for GST returns submission, income tax returns, MCA online forms and other web-based services. It validates the integrity of the document and authenticates the user’s identity. It assures the receiver that the data mentioned is unaltered and the document is untampered.

Encrypt

A person can use the Encrypt Certificate to encrypt files, documents or other sensitive and confidential data. DSC encryption is for confidential documents and data. It helps enterprises and companies to encrypt and upload documents on web portals. This certificate can also be used to encrypt personal data and send it securely. Encrypt DSC is suitable for e-commerce documents, legal documents, e-tender filing documents and other confidential records.

Sign and Encrypt

A person can use the Sign and Encrypt Certificate for both signing and encrypting purposes. It is usually used for filing government documents, forms and applications. It is suitable for those users who need to maintain and authenticate the confidentiality of the data exchanged.

31Oct

31OctIndia–UK Deepen Collaboration in AI & HealthTech Innovation: Building a Smarter Future IntroductionIndia...

30Oct

30OctGlobal Growth Outlook 2026: Tariff Hangover Meets Relief from Falling Oil Prices...

29Oct

29OctIndia’s Global Business Moves: Cross-Border Acquisitions & Strategic Investments (October 2025) India’s...