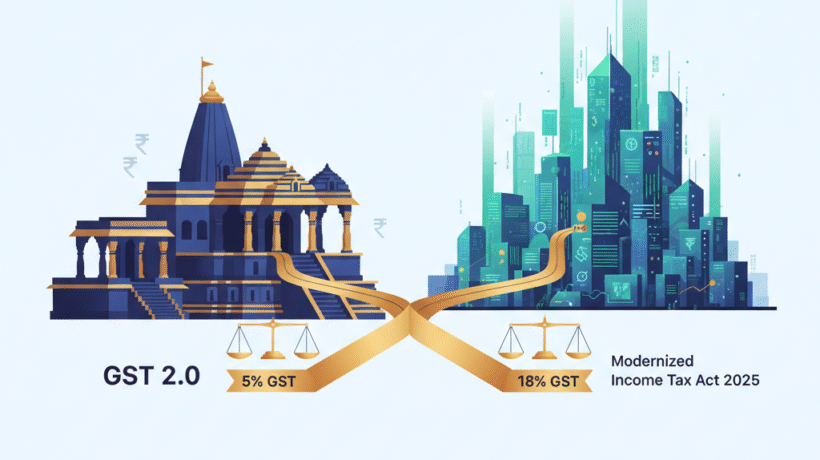

India’s New Tax Era: GST 2.0 Simplified Rates and Income Tax Act 2025 Modernization

Introduction

September 2025 marks a transformative phase in India’s tax landscape. With the rollout of GST 2.0 and the implementation of the Income Tax Act, 2025, the government has introduced sweeping reforms to simplify compliance, enhance transparency, and promote ease of doing business. Together, these changes strengthen India’s position as a modern, digitally driven economy ready for the next decade of growth.

GST 2.0: A Simpler, Smarter Indirect Tax System

On September 22, 2025, India launched GST 2.0, marking one of the most significant updates since GST’s original introduction in 2017. The reform aims to simplify rate structures and reduce the compliance burden on businesses.

Key Highlights of GST 2.0

Two-Slab Structure:

The new system now features only two main slabs — 5% (reduced) and 18% (standard). The 12% and 28% categories have been removed for most goods and services.

Luxury and Sin Goods:

A 40% rate is now applicable on specific luxury and sin goods, including tobacco products, carbonated drinks, and high-end imported items, maintaining revenue neutrality while discouraging consumption of non-essential items.

Simplified Compliance:

GST 2.0 also includes pre-filled returns, faster refunds, and real-time invoice tracking, particularly benefiting MSMEs.

Benefits for Businesses and Consumers

For Businesses:

Easier classification of goods and services.

Reduced compliance cost and errors in filings.

Faster input credit processing and refunds.

For Consumers:

More predictable pricing.

Reduced cascading tax effects.

Transparency in tax components displayed on bills.

Indian Context:

The GST Council continues to work with the Central Board of Indirect Taxes and Customs (CBIC) to ensure smooth transition and compliance support for small businesses through digital tools and grievance portals.

Income Tax Act, 2025: A Digital, Modern Framework

Coming into force on September 1, 2025, the Income Tax Act, 2025 replaces older provisions with a plain-language, technology-driven structure designed for clarity and efficiency.

Major Features of the New Income Tax Act

Plain-Language Drafting:

The new Act uses simplified language, making it easier for taxpayers, accountants, and legal professionals to interpret provisions.

Structured Schedules:

Income categories and exemptions are organized into clearer sections, helping individuals and corporations navigate filing requirements efficiently.

Digital-First Enforcement:

AI-based assessments to flag discrepancies automatically.

Online dispute resolution mechanisms for faster case closure.

Integrated PAN-based compliance tracking across GST, TDS, and income tax systems.

Streamlined Dispute Resolution:

The Act prioritizes conciliation over litigation, allowing taxpayers to settle disputes digitally through pre-assessment clarification portals.

Impact on Businesses and Individuals

For Businesses:

Reduced administrative burden and faster tax assessments.

Seamless integration of direct and indirect tax data.

Greater transparency in enforcement.

For Individuals:

Simpler return filing with fewer forms.

Clear deduction and exemption guidelines.

Faster refund and grievance redressal timelines.

Global and Indian Economic Context

Globally, India’s twin reforms — GST 2.0 and the Income Tax Act, 2025 — reinforce its image as a pro-reform, investor-friendly economy. International financial institutions like the IMF and World Bank have consistently emphasized the need for streamlined tax systems to support sustainable growth.

These moves place India in alignment with OECD best practices, emphasizing digital governance, ease of compliance, and transparency in public finance.

Key Benefits and Challenges

Benefits:

Simplified tax rates and structures.

Increased digital integration and transparency.

Boost to investor confidence and MSME growth.

Efficient dispute resolution and compliance monitoring.

Challenges:

Initial transition and system adaptation for taxpayers.

Training and awareness requirements for small enterprises.

Continued vigilance needed to prevent evasion in high-tax categories.

Practical Takeaways

For Businesses: Upgrade your accounting systems for new GST and income tax frameworks; leverage digital tools for compliance automation.

For Individuals: Review your income tax obligations under the new law and ensure proper documentation for deductions.

For MSMEs: Take advantage of simplified GST filing and pre-filled returns to reduce administrative time and cost.

Conclusion

The introduction of GST 2.0 and the Income Tax Act, 2025 together symbolize India’s shift toward simpler, smarter, and technology-enabled taxation. These reforms not only improve compliance efficiency but also strengthen the foundation for long-term economic growth and ease of doing business.

Special Offer: Avail 25% discount on Private Limited Company Registration and Trademark Filing Fees today.

For expert assistance on GST, taxation, company registration, or legal compliance, contact us now at meracompliance.com

your trusted partner for business growth.

FAQ'S

1. What is GST 2.0?

GST 2.0 is the updated version of India’s Goods and Services Tax, simplifying rates to two main slabs — 5% and 18% — and streamlining compliance for businesses.

2. What are the new GST rates under GST 2.0?

The slabs are now 5% (reduced), 18% (standard), and 40% for luxury and sin goods.

3. When did the new Income Tax Act, 2025 come into effect?

It came into effect on September 1, 2025.

4. How is the new Income Tax Act different from the old one?

It focuses on plain-language drafting, digital-first enforcement, and faster dispute resolution.

5. Will businesses need to change their accounting systems?

Yes, updates are required to align with new GST structures and digital income tax compliance.

6. What benefits do MSMEs get from these reforms?

Simplified returns, faster refunds, and reduced documentation burdens under both GST and income tax systems.

7. Where can I get professional help with GST and company registration?

You can visit meracompliance.comfor expert tax, registration, and compliance support.